The Chicago City Council has approved a Class L tax incentive for the redevelopment of the Hoyt Building at 465 W. Cermak. Located within the Cermak Road Bridge District, the building sits along the south branch of the Chicago River on the south side of W. Cermak Rd. Developer Windfall Group is behind the mixed-use adaptive reuse.

Originally designed by architects Nimmons and Fellows and completed in 1909, the facade was designed with brick piers ornamented with limestone and terracotta details. The entrance to the Hoyt Company’s offices on the second floor is centered on the Cermak Road elevation with an ornamental terracotta surround. On the interior, concrete columns support large, open floor plates.

With SPACE Architects + Planners on board for the adaptive reuse, the redeveloped building will hold a 4-star extended stay hotel, a grocery store, retail, dining, entertainment, a spa, and a medical center. The larger development will include new retail and a parking garage on adjacent lots.

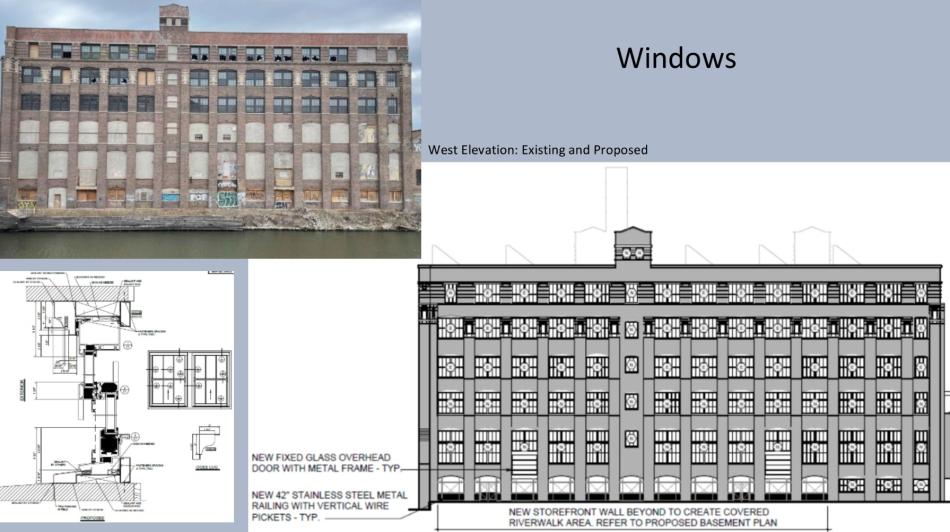

The $40.8 million project will fully rehabilitate the building envelope, replacing damaged masonry where needed and repointing masonry joints to match the existing mortar. Some of the windows were previously replaced in 2018, so planned work will repair and replace existing windows as needed while restoring window openings that were infilled with concrete block or plywood.

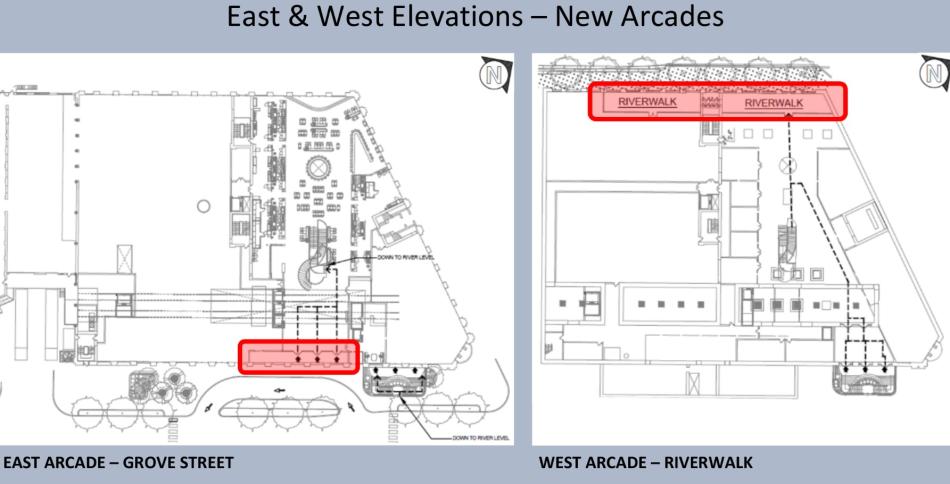

At the base of the building, a new arcade will be carved into the east elevation by inserting a new glazed storefront system 8 feet behind the masonry piers to create an entryway into the building. To the north of the new entry arcade is a sunken plaza that will create a publicly accessible walkway through the building to a new portion of riverwalk. The new riverwalk will be complimented by a second new arcade that sets into the lower level almost 14 feet.

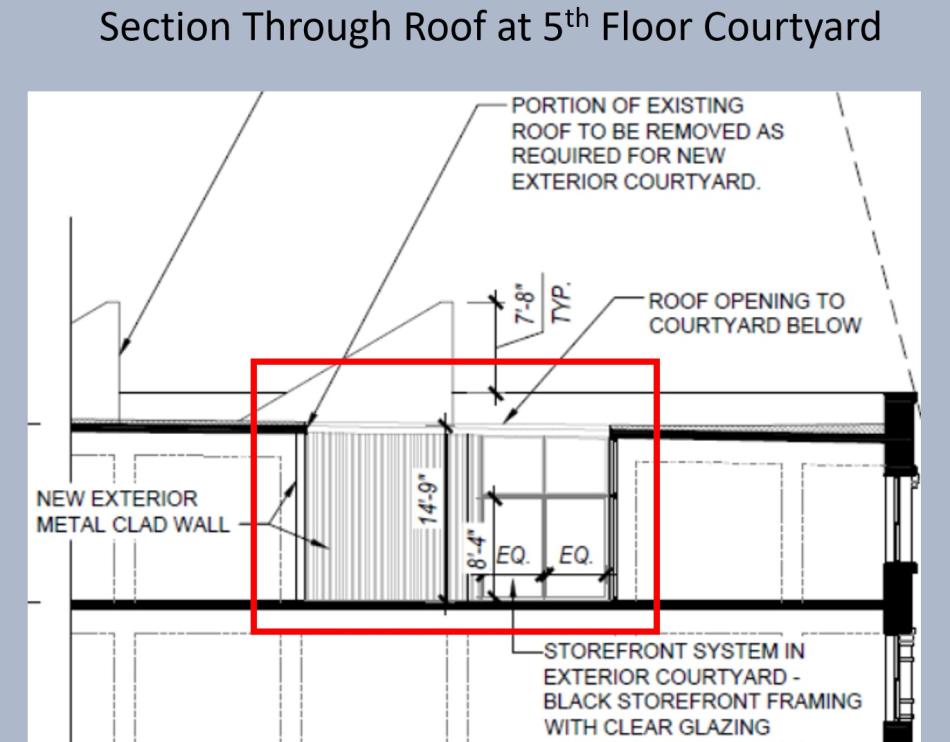

On the roof, the rehab will replace the glazing in the skylights and add rooftop solar panels. New HVAC units will provide the building with modern ventilation and cooling. Three new elevator shafts will be carved into the building and overruns will rise out of the roof accordingly. On the top floor of the building, portions of the roof will be removed to create courtyards which will be framed with new glazed storefronts and metal cladding.

The development will have a minimum investment of just under $5 million, with the expenditure of $32.3 million in qualifying rehabilitation expenses. This expenditure exceeds the 50% minimum investment required to qualify for the Class L tax incentive. As outlined, the development will have a total tax abatement of approximately $15.5 million over the 12-year period of the tax incentive.

With approval from the City Council secured, the development is one step closer to starting construction. The developers expect to break ground in Summer 2024 and complete construction in Spring 2026.