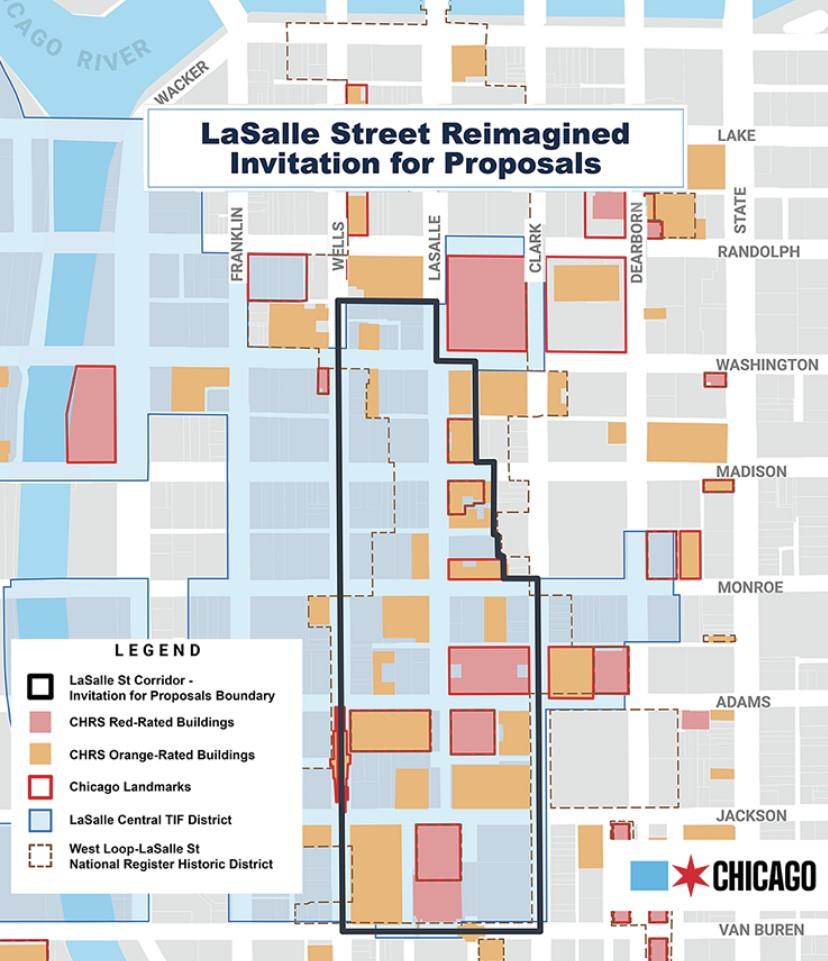

Developers have answered the call for proposals to reimagine the Loop’s LaSalle Street corridor as a new mixed-use district. Plagued with vacancies, the corridor is littered with empty historic office buildings that no longer meet the current market demands of new office tenants. Originally announced at the end of September, Mayor Lightfoot and the Department of Planning and Development identified the bounds of eligible buildings to be those along LaSalle St, stretching from W. Washington St down to W. Van Buren St.

While all of these projects would be developed privately, the initiative is offering up an array of public resources to help finance the conversions. Those resources are expected to include federal tax credits, Cook County property tax incentives, Tax Increment Financing, PACE financing, Low Income Housing Tax Credits and other tools, subject to the review and approval of relevant public agencies and the Chicago City Council. With a large focus on housing and specifically affordable housing, all proposals must include 30% affordable housing to receive the city support.

With seven buildings and nine competing proposals, the potential investment lands near $1.2 billion and just over 2,000 units. Here are the proposals broken down by building:

400 S. LaSalle

Starting at the south end of the corridor, developer Urban Resolve has proposed to convert the six-story structure into 226 beds of student housing along with a food court, fitness center, and a mental health center. Formerly the CBOE Global Markets headquarters, the $104 million conversion will also include an esports arena.

--

208 S. LaSalle

Heading up the block is 208 S. LaSalle, which already had office floors converted into hotels, including a JW Marriott and The LaSalle. Led by The Prime Group, the latest plan would convert a portion of the upper floors into 84 apartments. Set to cost $130 million, the new residences would be served by a dog run, fitness center, lounge, and access to the hotel amenities.

However, a competing proposal has also been submitted for the same space. A cooperation between Sims Property Development & Management and Brinshore Development would create 102 apartments in their $50.2 million proposal.

--

135 S. LaSalle

As the former home of Bank of America, Chicago’s Riverside Investment & Development is looking to convert the entire 44-story building into 430 apartments. Set to run $258 million the venture would be a partnership with Blue Star Properties and the building’s owner AmTrust. The base of the building would become home to up to 80,000 square feet of lobby, retail, restaurant, event, and cultural space. This site has been eyed for a potential grocery store, something the area is severely lacking.

--

105 W. Adams

Also known as the Clark-Adams Building, the 1927 tower has been eyed by Maven Development Group for 432 apartments on the upper 31 floors. Spending $167 million, this plan would not include the lower 10 floors which are currently home to a Club Quarters Hotel and Elephant & Castle Pub.

Overlooking Federal Plaza to the east, the structure is lucky enough to be one of the two buildings with competing proposals. Coming from Blackwood Group and Celadon Partners, this alternate concept would spend $192 million converting the empty space into 185 units, with a two-level food market and a Stockyards Coffee House at the base.

--

111 W. Monroe

Overlooking the corner of W. Monroe St and S. Clark St, developers Prime Group and Capri Capital Partners are seeking to create 349 apartments with 105 of them set aside as affordable. Previously the headquarters of BMO, the 1974 structure would also see the addition of a hotel on the lower seven floors, plus a spa, rooftop pool, and restaurant all adding up to a $180 million conversion.

--

30 N. LaSalle

With the building’s owner AmTrust currently going through a foreclosure suit on the property, developers Golub & Co. and investor American General Life Insurance are looking to convert the 43-story tower into 432 apartments. Set to run them $186 million, the building would have new ground-floor retail space as well as green spaces and seating along its street frontages.

--

170 W. Washington

Ending our breakdown at the northern end of the district, this final proposal also happens to be the smallest. Building owners, restaurateurs, and businessmen Scott Cochrane, Kevin Killerman, and Carmen Rossi are looking to convert the building into four apartments with new ground-floor retail and commercial spaces, with them likely including a restaurant of their own. Built in 1930, the plan to convert the five-story building is expected to cost about $2 million.

--

With these nine proposals submitted, the city will now review them to determine their feasibility and to decide how much TIF funding, if any, they will allot. Currently, the LaSalle Central TIF district is reported to have $197 million in funds available. The city plans to announce the first winners in a few months and construction could commence as soon as 2024.